I have spent most of my working years thinking about Cloud services and offering them at Truehost Cloud. I have experienced great success and also failures. Now that it is the time of the year that I audit my life because I am turning one year older, I decided to share some lessons learnt through the journey.

Nothing special about 17; it is just that they came to that number. If I had some good time I would collapse them to fewer, or add more which would take more time to put in words. I hope you will relate with some of them in your business, or even in life.

Note: Not in the order of importance.

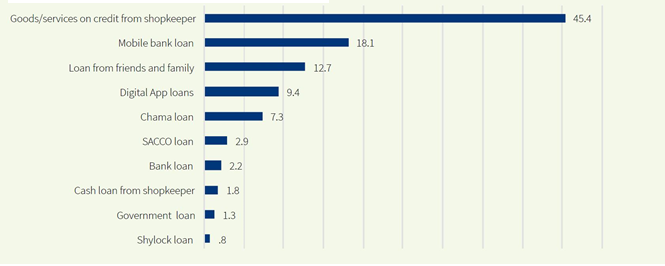

- Cash is king. You need to have cash when you need it, otherwise you will stall. You can find innovative ways of minimizing your need for cash by having lean operations, but the moment the cash needed exceeds cash at hand, your growth will be impacted.

- However, sometimes the need for cash may not be as critical as it appears, for many times cash shortage has forced people to innovate in ways they would not have thought possible.

- A sale is very important. It doesn’t matter how great your product is if you are not selling. There are many great products out there which no one is buying, while some not very good products continue to dominate the market.

- Execution is more important than the idea. It only matters a little how creative, smart, connected or even experienced you are. Only those who can execute what they envisage are successful. History is full of smart geniuses who died empty for they did nothing. So are entrepreneurs. Take the first step and get it working.

- It might take a lifetime to get it right, but you have to keep doing it. The world also changes, and what worked yesterday might not work today, thus a need for one to be on the move, and to keep trying.

- The customer is number one. Work for the customer and the mission will make sense for everybody else.

- Dream big, but also wake up and work hard. There is so much one can achieve if only they can dream it possible.

- Working smart is overrated, even for those born with a silver spoon in their mouth. You have to do a lot of work and get your hands dirty of you are to stay on top of the game.

- There is a (big) place for luck in business, but it falls on those who try more. If you keep doing things, and learning, and trying again, and refining your strategy, you will get lucky.

- You need a team. A team is hard to build, and a team is as strong as the weakest member. Build a strong team and you can take any challenge.

- There is no substitute for knowledge and experience. Businesses collapse due to lack of knowledge. Get knowledge at all costs, and learn as much as you can.

- The longer you do business, the better you become. Start early and rise up fast when you fail.

- Your networks matter a lot. Build great networks and use them where possible. Your friends might be your first clients and your main marketing channels.

- Entrepreneurship is hard for people who do not have a social safety net. This is because at some point you will fail and you will need a support system. However, if it is necessary, burn the ships and get in there headlong. I don’t promise that you won’t regret that move.

- Some things excelled because they were launched at the right time. But even with timing being right, the other factors must also be right to survive.

- Do not underestimate yourself. More important, do not overrate yourself. If you succeed, do not think you are good, while if you fail, do not think you cannot do it.

- Learn from other people in business. You can learn a lot by asking other people who have been there and avoid repeating their mistakes while acquiring their best practices. Reinventing the wheel might good for experience and exposure, but stupid for your cash book.

Thanks to the team at Truehost Cloud for the support.

Found something helpful? Go ahead and share!