Kenya is a first of many, but it is possibly the SACCO movement that stands tallest, although little talked about. In terms of savings, Kenya has the largest SACCO movement in Africa, and SACCOs have been the preferred source of credit for many people. But just like with any thriving industry, disruptions are always around the corner and while SACCOs depended on a good savings history to loan people money, a new form of lending that depends more on the reputation of the borrower more than their saving history has taken a big share of the market. The term for it is digital loans.

Growth of digital Lending in Kenya

With the advent of mobile phones and increased internet penetration, borrowing of money has been shifting from the traditional channels to electronic channels. Financial institutions started digitizing their services and started taking advantage of the digital economy. One of those steps was to make financial transactions faster and lending more efficient. However, it was not until 7 years ago that digital lending became popular with the launch of M-Shwari (a partnership between Safaricom’s Mpesa and Commercial Bank of Africa, CBA). Today, there are over 50 digital lending apps in Kenya that are churning out loans worth millions of shillings every day.

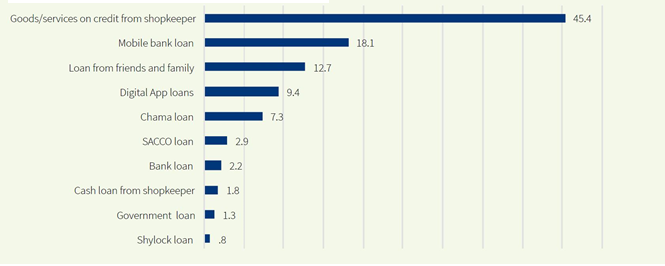

The lending apps exploit social information and apply various artificial intelligence tools to determine creditworthiness. This involves factors such as your mobile phone airtime usage, the amount of money you transact every month, your likes, location, Facebook friends and even how you save people in your phonebook. Algorithms are able to analyze the data and determine how much you are worth with some astounding levels of accuracy. This is possibly why there are less defaulters of mobile money loans than there are for shopkeepers, banks and loans from friends and family as shown in the figure below.

Impact of Digital Loans

There has been a lot of talk on financial inclusion afforded by these mobile apps. Many people who could never afford credit are now able to get cash to boost their businesses, pay school fees, or for whatever purpose. Banking on the high penetration of mobile money in Kenya, it is now faster and easier than ever to get a credit facility and have the money sent directly to your phone. The number of people who use these apps keeps growing.

But on the flipside, there is the dark side of the mobile-based loans. While most of these digital platforms do not charge interest, they have what is called set-up fee for every loan. While most of them are very short term in nature, the effective ‘interest’ charged by these apps comes to about 90% p.a for the conservative ones like M-Shwari and KCB-MPESA, and up to 180% p.a for Tala and Branch. These rates make the poor people who need these loans to use the most expensive form of credit that anyone can get. In comparison, SACCO loans charge an average of 12% per year while banks are limited to not more than 4% above Central Bank of Kenya lending rate, which would translate to 13% per year.

How SACCOs can intervene

For ages, SACCOs have occupied a prime spot when it comes to lending. However, they are not the preferred go-to shop when one urgently needs a loan of KES 500, 1000, or 15,000. This is the market that has been left to digital lending apps. Yet, it is the members of these SACCOs who go ahead to borrow from these apps. SACCOs would be better positioned to offer these micro loans, as they already have members’ savings as security, and their interest rates would be more affordable. This would make the credit more affordable, non-predatory and low risk.

Unfortunately, most SACCOs in Kenya are small in nature, and lack the financial muscle to deploy systems that can allow them to lend to their members using mobile apps. There already exists systems and mobile apps that can allow for SACCOs to do this, but the adoption of these systems is still low for the majority of the SACCOs. Many also have a high staff turnover rate, and depend on semi trained personnel to run the operations. This makes it even harder for these SACCO to intervene. Perhaps, the government and umbrella bodies should focus on how to get an effective system for the SACCOs which will help them face the Silicon Valley based lenders.

What do you think?